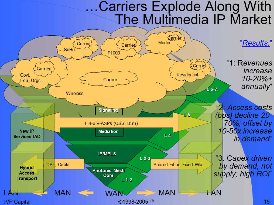

I first started using clouds in my presentations in 1990 to illustrate Metcalfe’s Law and how data would scale and supersede voice. John McQuillan and his Next Gen Networks (NGN) conferences were my inspiration and source. In the mid-2000s I used them to illustrate the potential for a world of unlimited demand ecosystems: commercial, consumer, social, financial, etc… Cloud computing has now become a part of everyday vernacular. The problem is that for cloud computing to expand the world of networks needs to go flat, or horizontal, as in this complex looking illustration to the left.

I first started using clouds in my presentations in 1990 to illustrate Metcalfe’s Law and how data would scale and supersede voice. John McQuillan and his Next Gen Networks (NGN) conferences were my inspiration and source. In the mid-2000s I used them to illustrate the potential for a world of unlimited demand ecosystems: commercial, consumer, social, financial, etc… Cloud computing has now become a part of everyday vernacular. The problem is that for cloud computing to expand the world of networks needs to go flat, or horizontal, as in this complex looking illustration to the left.

This is a static view. Add some temporality and rapidly shifting supply/demand dynamics and the debate begins as to whether the system should be centralized or decentralized. Yes and no. There are 3 main network types: hierarchical, centralized and fully distributed (aka peer to peer). None fully accommodate metcalfe’s, moore’s and zipf’s laws. Network  theory needs to capture the dynamic of new service/technology introduction that initially is used by a small group, but then rapidly scales to many. Processing/intelligence initially must be centralized but then traffic and signaling volumes dictate pushing the intelligence to the edge. The illustration to the right begins to convey that lateral motion in a flat, layered architecture, driven by the 2-way, synchronous nature of traffic; albeit with the signalling and transactions moving vertically up and down.

theory needs to capture the dynamic of new service/technology introduction that initially is used by a small group, but then rapidly scales to many. Processing/intelligence initially must be centralized but then traffic and signaling volumes dictate pushing the intelligence to the edge. The illustration to the right begins to convey that lateral motion in a flat, layered architecture, driven by the 2-way, synchronous nature of traffic; albeit with the signalling and transactions moving vertically up and down.

But just as solutions begin to scale, a new service is borne superseding the original. This chaotic view from the outside looks like an organism in constant state of expansion then collapse, expansion then collapse, etc…

A new network theory that controls and accounts for this constant state of creative destruction* is Centralized Hierarchical Networks (CHNs) CC. A search on google and duckduckgo reveals no known prior attribution, so Information Velocity Partners, LLC (aka IVP Capital, LLC) both lays claim and offers up the term under creative commons (CC). I actually coined the CHN term in 2004 at a Telcordia symposium; now an Ericsson subsidiary.

CHN theory fully explains the movement from mainframe to PC to cloud. It explains the growth of switches, routers and data centers in networks over time. And it should be used as a model to explain how optical computing/storage in the core, fiber and MIMO transmission and cognitive radios at the edge get introduced and scaled. Mobile broadband and 7x24 access /syncing by smartphones are already beginning to reveal the pressures on a vertically integrated world and the need to evolve business models and strategies to centralized hierarchical networking.

*--interesting to note that creative destruction was original used in far-left Marxist doctrine in the 1840s but was subsumed into and became associated with far-right Austrian School economic theory in the 1950s. Which underscores my view that often little difference lies between far-left and far-right in a continuous circular political/economic spectrum.

Related Reading:

Decentralizing the Cloud. Not exactly IMO.

Network resources will always be heterogeneous.

Everything gets pushed to the edge in this perspective