Why App Coverage Will Drive Everything

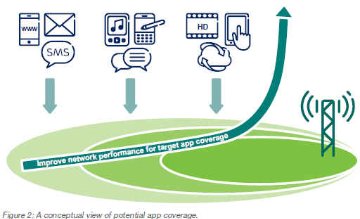

Given the smartphone’s ubiquity and our dependence on it, “App Coverage” (AC) is something confronting us every day, yet we know little about it. At the CCA Global Expo this week in San Antonio Glenn Laxdal of Ericsson spoke about “app coverage”, which the vendor first surfaced in 2013. AC is defined as, “the proportion of a network’s coverage that has sufficient performance to run a particular app at an acceptable quality level.” In other words the variety of demand from end-users for voice, data and video applications is outpacing the ability of carriers to keep up. According to Ericsson, monitoring and ensuring performance of app coverage is the next wave in LTE networks. Here’s a good video explaining AC in simple, visual terms.

coverage is the next wave in LTE networks. Here’s a good video explaining AC in simple, visual terms.

Years, nay, decades ago I used to say coverage should be measured in 3 important ways:

- Geographic (national vs regional vs local)

- In/Outdoors (50+% loss indoors)

- Frequency (double capex 1900 vs 700 mhz)

Each of these had specific supply/demand clearing implications across dozens of issues impacting balance sheets and P&L statements; ultimately determining winners and losers. They are principally why AT&T and Verizon today have 70% of subscribers (80% of enterprise customers) up from 55% just 5 years ago, 84% of total profit, and over 100% of industry free cash flow. Now we can add “applications” to that list. And it will only make it more challenging for competitors to wrestle share from the “duopoly”.

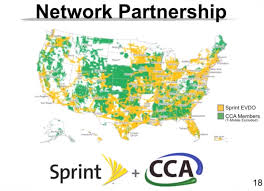

Cassidy Shield of Alcatel-Lucent, further stated that fast follower strategies to the duopoly would likely fail; implying that radical rethinking was necessary. Some of that came quickly in the form of Masayoshi Son’s announcement of a broad partnership with NetAmerica and members of CCA for preferred roaming, concerted network buildout and sharing of facilities and device purchase agreements. This announcement came two weeks after Son visited Washington DC and laid out Sprint’s vision for a new, more competitive wireless future in America.

Cassidy Shield of Alcatel-Lucent, further stated that fast follower strategies to the duopoly would likely fail; implying that radical rethinking was necessary. Some of that came quickly in the form of Masayoshi Son’s announcement of a broad partnership with NetAmerica and members of CCA for preferred roaming, concerted network buildout and sharing of facilities and device purchase agreements. This announcement came two weeks after Son visited Washington DC and laid out Sprint’s vision for a new, more competitive wireless future in America.

The conference concluded with a panel of CEOs hailing Sprint’s approach, which Son outlined here, as one of benevolent dictator (perhaps not the best choice of words) and exhorting the label partner, partner, partner; something that Terry Addington of MobileNation has said has taken way too long. Even then the panel agreed that pulling off partnerships will be challenging.

The Good & Bad of Wireless

Wireless is great because it is all things to all people, and that is what makes it bad too. Planning for and accounting how users will access the network is very challenging across a wide user base. There are fundamentally different “zones” and contexts in which different apps can be used and they often conflict with network capacity and performance. I used to say that one could walk and also hang upside down from a tree and talk, but you couldn’t “process data” doing those things. Of course the smartphone changed all that and people are accessing their music apps, location services, searches, purchases, and watching video from anywhere; even hanging upside down in trees.

Today voice, music and video consume 12, 160 and 760 kpbs of bandwidth, respectively, on average. Tomorrow those numbers might be 40, 500, 1500, and that’s not even taking into account “upstream” bandwidth which will be even more of a challenge for service providers to provision when consumers expect more 2-way collaboration everywhere. The law of wireless gravity, which states bits will seek out fiber/wire as quickly and cheaply as possible, will apply, necessitating sharing of facilities (wireless and wired), heterogeneous network (Hetnet), and aggressive wifi offload approaches; even consumers will be shared in the form of managed services across communities of users (known today as OTT). The show agenda included numerous presentations on distributed antennae networks and wifi offload applied to the rural coverage challenge.

Developing approaches ex ante to anticipate demand is even more critical if carriers want to play major roles in the internet of things, unified (video) communications and the connected car. As Ericsson states in its whitepaper,

“App coverage integrates all aspects of network performance – including radionetwork throughput and latency, capacity, as well as the performance of the backhaul, packetcore and the content-delivery networks. Ultimately, managing app coverage and performance demands a true end-to-end approach to designing, building and running mobile networks.”